Use this calculator to help you determine your monthly car loan payment or your car purchase price. After you have entered your current information, use the graph options to see how different loan terms or down payments can impact your monthly payment. You can also examine your complete amortization schedule by clicking on the "View Report" button. You can also examine your complete amortization schedule by clicking on the 'View Report' button. Purchasing a vehicle usually requires a significant financial investment.

Even a modestly priced vehicle—let's say $8,000 to $10,000—is more than most people can afford to pay with cash. Which means most people need to take out an auto loan in order to buy a car. Our car loan calculator can do all the hard work for you. Experts suggest that you should not allocate more than 20% of your take-home pay towards monthly auto payments. The down payment, interest rate and term of your loan will also determine how much you can afford to buy. First of all, figure out how much you can afford to borrow.

Tools like this auto loan calculator can help you get an idea. But don't forget to consider the total cost of owning a car, which can include expenses like auto insurance, fuel and maintenance. And while it may be tempting, avoid stretching out your loan term to bring down your monthly car payment. You could end up paying thousands more in interest over the life of the loan.

The best way to lower your vehicle payment is to put money down when you initiate the deal. For example, if you're buying a $20,000 vehicle, your auto loan would be for $20,000, plus whatever the interest is. But with a $4000 down payment, you'll only have to take out a $16,000 loan, plus interest. The benefit here, aside from a lower sale price, is that you will have lower monthly payments. Try using different down payments in the car loan calculator Canada! The car loan calculator is a tool that does more than just show you a monthly car loan payment.

Use it to compare lender offers and try different interest rates and loan terms. The knowledge you gain can help you negotiate with lenders and dealers and ultimately choose the best auto loan for your financial situation. Your loan term -- or the amount of time you'll be paying back the loan -- will impact the price of your monthly car payments. With a shorter-term auto loan, your monthly payments will be higher, but you will have a lower APR and pay less in interest in the long-run. Use the auto loan calculator to see the difference in monthly payments and interest paid depending on the term of the auto loan.

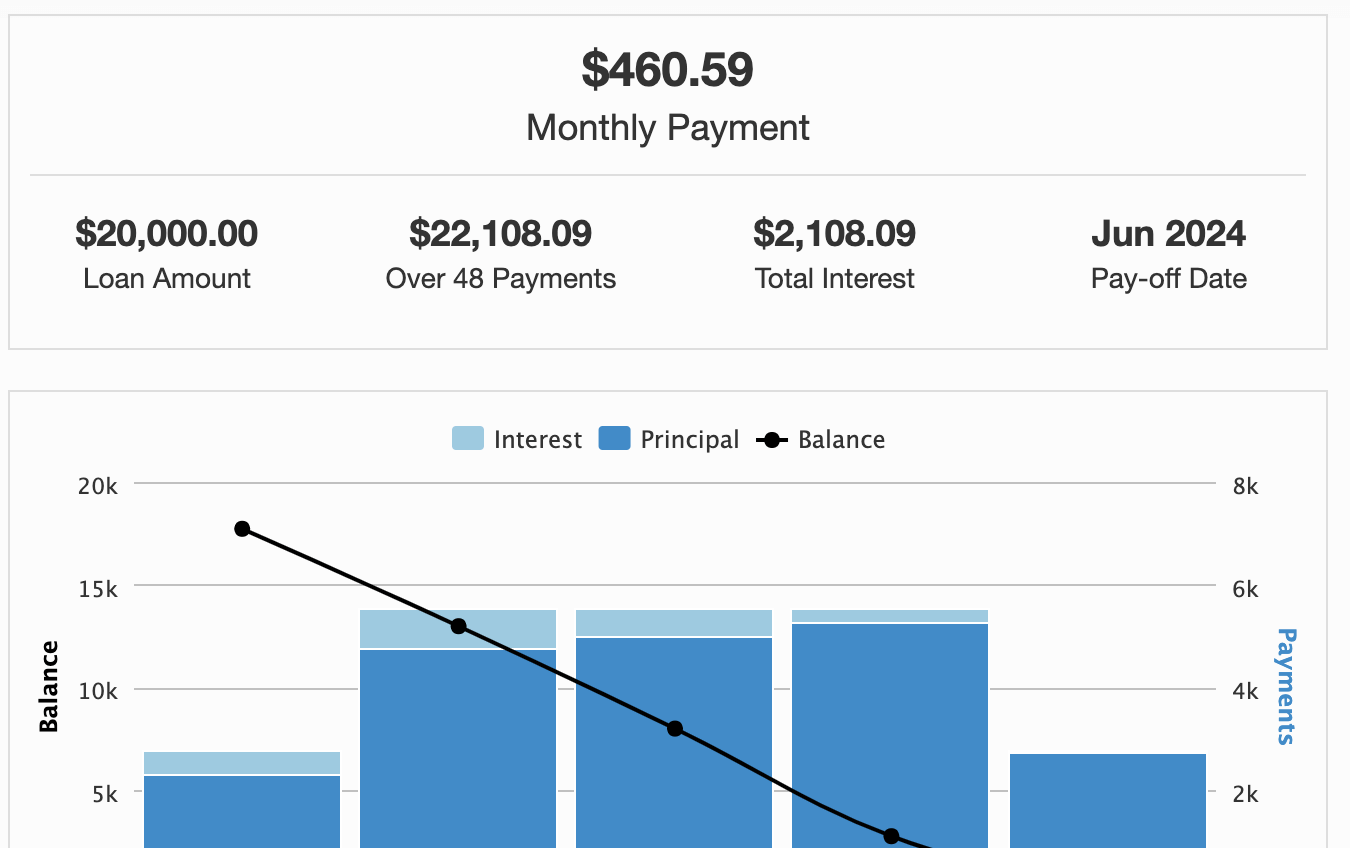

An auto loan calculator shows the total amount of interest you'll pay over the life of a loan. If the calculator offers an amortization schedule, you can see how much interest you'll pay each month. With most car loans, part of each payment goes toward the principal , and part goes toward interest. It shows how the loan progresses throughout its tenure including monthly payable EMIs, total interest paid, amounts overdue after each paid EMIs etc. Bankrate's auto loan calculator will give you a good idea of how much car you can afford from a monthly payment standpoint.

Start with a list of vehicles that you're interested in and estimated purchase prices. Then subtract the amount of money you can use for a down payment and an estimate of your current car's trade-in value. Lastly, compare costs to make sure that the calculated auto loan payment based on the amount you need to borrow aligns with your monthly budget.

APRs appearing in rate tables and/or calculator results are based on your input and are subject to change at any time. Additional terms and conditions apply such as vehicle age and mileage. Consider checking your credit report occasionally to be sure inaccuracies aren't impacting your ability to receive credit.

Calculator results are also based on your selected dealer state, loan-to-value ratio of 100% and only apply to car purchases from a dealer in the Chase network. Use our auto loan calculator to estimate your monthly car loan payments. Enter a car price and adjust other factors as needed to see how changes affect your estimated payment. A range of factors — including your credit scores and credit history, loan amount, loan term and your down payment — can affect the interest rate your lender may offer. See the table in the next section for the average interest rates that people with different credit scores received on auto loans in the first quarter of 2021.

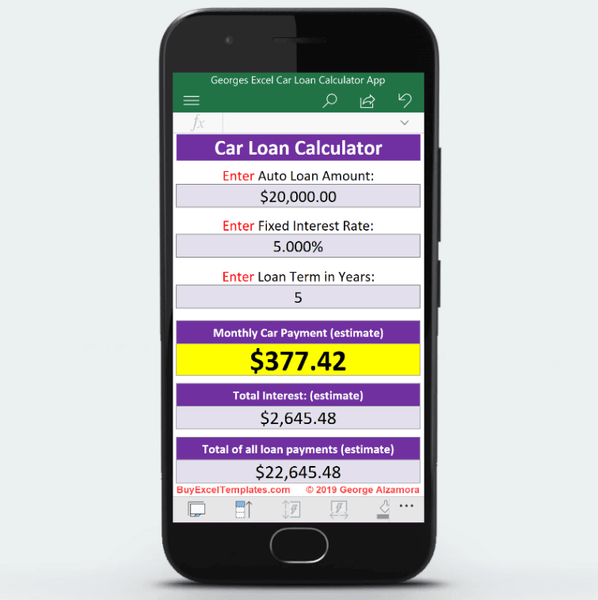

You can make use of the Car Loan EMI calculator to estimate the amount you have to pay each month towards your car loan. Buying any new or used car can get overwhelming when you have no clue of where to begin from the money standpoint. One of the keys to a successful car purchase has always been being able to figure out what you can manage financially. So, to that end, use our car loan calculator to get an idea of what you can afford! All you have to do is plug in your desired monthly payment or your desired vehicle price. Enter a total loan amount into this auto loan calculator to estimate your monthly payment, or determine your loan amount by car price, trade-in value and other factors.

Our calculator can help you estimate your monthly auto loan payment, based on loan amount, interest rate and loan term. It'll also help you figure out how much you'll pay in interest and provide an amortization schedule . With our car loan calculator you'll see how much you can borrow for a used or new car and what you'll be paying over your set term. Our calculators work out your interest automatically so you'll see your principal and interest amounts, including what you'll save with an extra repayment or two. Calculate your repayments on a monthly, fortnightly or weekly basis and plan for your future with a car loan from RACQ Bank. The factor that will change your monthly payment the most is the loan term.

The longer your loan, the less you'll pay each month, because you're spreading out the loan amount over a greater number of months. However, due to the interest you'll be paying on your loan, you'll actually end up spending more for your vehicle by the time your payments are over. Because the more time you spend paying off your loan, the more times you will be charged interest. As a business, a car loan may help you improve cash flow to your business as well as the potential to claim tax deductions if the car is being used for business purposes .

Any calculation made by you using this Car Loan calculator is intended as a guide only. It is for illustrative purposes only and is based on the accuracy of the information provided. The calculator does not take establishment fees, stamp duty or other government charges into account. The amount you can borrow may vary once you complete a loan application and all the details relevant to our lending criteria are captured and verified.

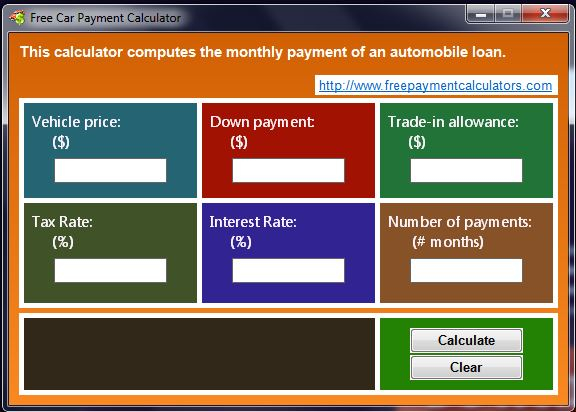

The calculations should not be relied on for the purpose of making a decision whether to apply for a car loan. Use this calculator to help you determine the monthly loan payment for your car, truck, boat, RV or motorcycle. Enter purchase price, monthly payment, down payment, term and interest rate to see how different loan terms or down payments can impact your monthly payment.

The auto loan calculator will display your estimated monthly auto payment. You will also see the total principal paid and the total interest paid. Add these two figures together to see the total amount you will pay for your new or used car over the life of the loan. Your monthly auto loan payment is based on the net purchase price of the vehicle, the loan term and the interest rate for the loan. The loan amount is based on the net purchase price of the vehicle or the vehicle price less any cash rebate, trade-in or down payment. If you have an outstanding balance on the vehicle you trade-in, that amount is added to the price of the vehicle you are purchasing.

Information and interactive calculators are made available to you only as self-help tools for your independent use and are not intended to provide investment or tax advice. We cannot and do not guarantee their applicability or accuracy in regards to your individual circumstances. All examples are hypothetical and are for illustrative purposes. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues. The table above isn't a guarantee of the rate you may be offered on an auto loan.

Secured loans like home loans and car loans, and unsecured loans like personal loans are repaid through Equated Monthly Installments . Car loan EMI is a fixed amount that the borrower pays to the lender/bank each month towards the repayment of the car loan till the end of the loan tenure. EMI consists of the principal loan amount and interest payment. If you're planning on financing your new vehicle purchase, the overall price of the vehicle isn't really the number you need to pay attention to. Because, as our auto loan calculator will show you, the price you ultimately end up paying depends on how you structure your deal.

Enter the amount you need to finance your car into the auto loan calculator. To calculate this, subtract your down payment and trade-in value amounts from your car's sticker price or MSRP. Information and interactive calculators are made available to you as self-help tools for your independent use and are not intended to provide investment advice. Use our car loan calculator to see what your monthly payment might look like—and how much interest you would pay over the life of the loan. Information and interactive calculators are made available to you as self-help tools for your independent use. We can not and do not guarantee their accuracy or their applicability to your circumstances.

Using this calculator does not constitute an application for credit, and we are not qualifying you for any credit product. We encourage you to seek personalized advice from qualified U.S. Bank professionals regarding all personal finance issues. Bank and its representatives do not provide tax or legal advice. You should consult your tax and/or legal advisor for advice and information concerning your particular situation. Shopping around and getting loan estimates from several lenders can help you find a loan that fits your budget.

While getting financing through a dealership can be convenient, you could end up paying a higher interest rate because of dealer markups. Consider getting quotes from different types of lenders — banks, credit unions and online lenders — to do some comparison shopping. Getting prequalified or preapproved isn't a guarantee you'll be approved for a loan, but it can give you sense of the loan amount, rate and terms you might be able to get. Just keep in mind that those loan terms could change once you submit your complete auto loan application.

Stretching your car loan payments out over a longer term could reduce your monthly payment, but you'll likely pay more interest. You also risk ending up owing more on your loan than your car is worth. Read more about the potential pros and cons of a longer loan term. We offer financing options for new or used cars, SUVs, trucks, vans and recreational vehicles that are sold privately or through dealerships. Try our vehicle loan calculator to see how much your monthly payments could be.

The best way to get a lower auto loan interest rate is to improve your credit score. If you have a low credit score, consider holding off on a car purchase until you can improve your score. Know that there isn't one "best" way to get the lowest monthly payment. It depends on your trade-in value, your credit history, your desired term, how much your willing to put down at the time of purchase, etc. If you're on a tighter budget, then choosing the lowest payment possible could be the best way to go. However, if you're able to pay more each month, then you'll be able to take a shorter term and have your vehicle paid off faster .

Many variables, including current market conditions, your credit history and down payment will affect your monthly payment and other terms. See your local dealer for actual pricing, annual percentage rate , monthly payment and other terms and special offers. Pricing and terms of any finance or lease transaction will be agreed upon by you and your dealer. The interest rate is the amount you'll pay each year to borrow money, expressed as a percentage. The interest rate is different from the annual percentage rate, or APR, which includes the amount you pay to borrow as well as any fees. Entering an estimated APR in the calculator instead of an interest rate will help provide a more accurate estimate of your monthly payment.

Estimate your monthly payments and how much you may be able to borrow, using the auto loan calculator below. Your monthly car payment is based on the loan amount, the loan term and the interest rate for the loan. Loan amount is based on the net purchase price of the vehicle or the vehicle price less any cash rebate, trade-in or down payment. We are serviceable in 65 locations, have satisfied upward of 45,000 customers through our service and provided hasslefree experience of RC transfer to about 26,000 customers. We are the trusted partners of all leading financiers of India such as HDFC Bank, Axis Bank, IDFC First bank, etc. You can begin your used car loan application here and we will help you process your used car loan with minimal hassle.

Do collect the entire repayment statement of your car loan from the bank which you can receive after submitting an application in the bank. This will be useful while updating the credit history in case of any discrepancies in your credit score and report. Annual percentage rate is the cost you pay each year for financing - it includes finance charges, fees, and other charges. Because financial institutions use credit scores to make sure you're able to repay a debt, creditors usually check your credit before quoting you an APR. The better the credit score, the more favorable APR you may receive.

Car loans are offered at fixed as well as floating interest rates. The fixed rate will remain unchanged for the tenure of the loan but the floating rate is subject to change from time to time. The different factors that can affect interest rates include applicable taxes, liquidity, inflation, etc.

Adjust the loan amount and loan term length on the loan payment calculator to see how it impacts your monthly payments. Auto loans have a minimum loan term of 12 months and minimum loan amount of $5,000. This is the amount of time a loans repayment is scheduled over. Typically a longer loan term means a buyer will have a lower monthly payment, but will pay more in interest over time.

The figures entered on the input page of this calculator are for hypothetical purposes only. You should enter figures that are appropriate to your individual situation. The results provided by this calculator are also intended for illustrative purposes only and accuracy is not guaranteed. Bank of America and its affiliates are not tax or legal advisers. The terms and conditions of products offered by institutions will differ and may affect the results of the calculator.

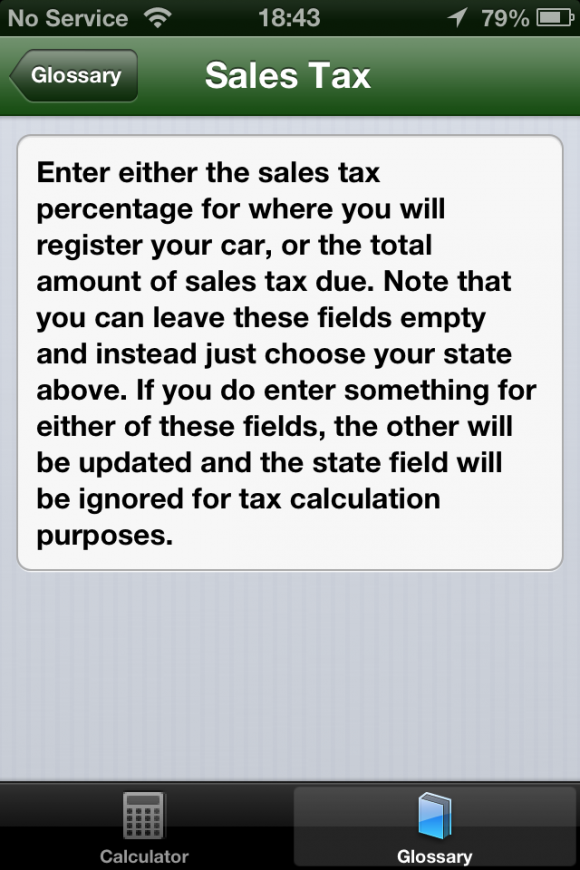

Please consult with qualified professionals to discuss your situation. The final APR may differ from the APR in the above results due to additional fees that may be applicable. The total amount you wish to finance for your auto loan (for example, the price of the car plus taxes and fees and minus any down payment or trade-in value).

Bank of America auto loans range from a minimum of $7,500 ($8,000 in MN) to a maximum of $100,000. The loan term is the period of time — typically expressed in months — you'll pay back your auto loan. Available loan terms vary by lender, but generally range from 12 to 84 months. A down payment is the percentage of the car's purchase price that you pay at the time of sale.