CashApp, formerly known as Square Cash, is from parent company Square, which is best known for providing payment processing platforms to small businesses. With CashApp, you can send and receive funds instantly via a linked debit card. There's no charge for using the service with a personal account, but there is a 3% fee when you use the business version.

CashApp only works with debit cards, so it's not the best fit if you prefer to use a credit card or linked bank account. CashApp also lets you invest in stocks and cryptocurrency, which is a neat feature if you're looking to experiment with small-scale investments. The best money transfer apps are free to download, but costs vary depending on how you use them. Be sure to check fees before assuming that all money transfers are free. PayPal is ubiquitous when it comes to payment options for freelance work.

The service is an established giant in the industry and is quick and convenient to use. Users also have the option or requesting money from friends, family and other contacts. There are no transaction fees when you send money using a linked bank account or PayPal Cash, but there is a 2.9% fee when you use a credit card, debit card or PayPal Credit. Users can also send money internationally, which is a nice feature if you have loved ones or professional contacts who don't live or bank in the United States. Venmo is a branch of parent company PayPal that's specifically designed to quickly and easily transfer money between friends, family and other contacts.

The app is integrated with Facebook and your phone contacts, so you can see others' activity in your newsfeed and easily find the right contact to send a payment to. If you get paid through Venmo, you have the option of transferring funds to your bank account. There's a 3% fee if you choose to send payments via a credit card. The best option when it comes to a money-sending app depends on your individual needs. Some apps are also better suited to particular purposes than others. If you already bank with a bank that uses Zelle, quick and easy money transfers are often already available within your mobile banking app.

Venmo is a popular option when it comes to splitting restaurant bills and bar tabs. If you're looking to send money internationally, WorldRemit may be the best choice. If you're a freelancer accepting payments from clients or sending money to contractors, PayPal is a popular option.

For each shift you work, you build up credit in your DailyPay account, which you can then transfer to your bank account at any time. The app charges a fee of $1.99 per transfer to receive your money by the next business day or $2.99 to receive your money instantly. When payday comes around, you receive your regular paycheck minus any advances you've requested.

According to DailyPay, the average employee using the service saves $1,205 in overdraft fees, late fees, and payday loan interest. SpotMe is more of an overdraft protection feature than a cash advance, but it still will ask if you want to tip for the service. Chime says your account can go negative up to your approved amount, and purchases that put you below that extra cushion will be declined. You need more than $500 in qualifying direct deposits to your Chime account every 31 days to qualify for SpotMe. A fee for its "instant" payment option — If you want your money within minutes, you'll have to pay.

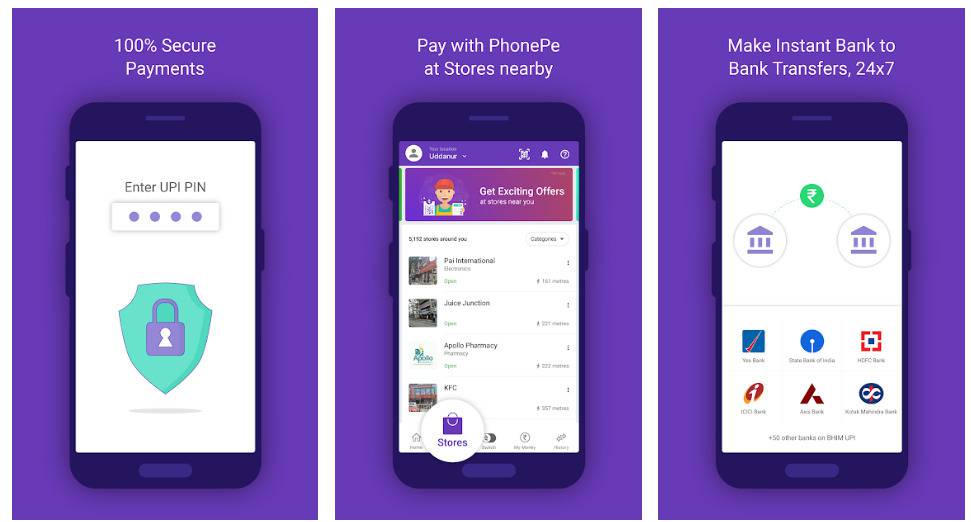

Branch charges $2.99 to $4.99 for instant "external" advances to your debit card, depending on the amount. Its standard paycheck advances are free but can take up to three business days to be deposited in your bank account, and may take even longer to access depending on your bank. Cash App is a mobile credit card processor–Square's answer to the growing popularity of peer-to-peer payments. Cash App does pretty much the same thing as Venmo, but without the social features. You can send money to, or request from, anyone with a Cash account, and funds are drawn from a linked bank account via debit card at no cost.

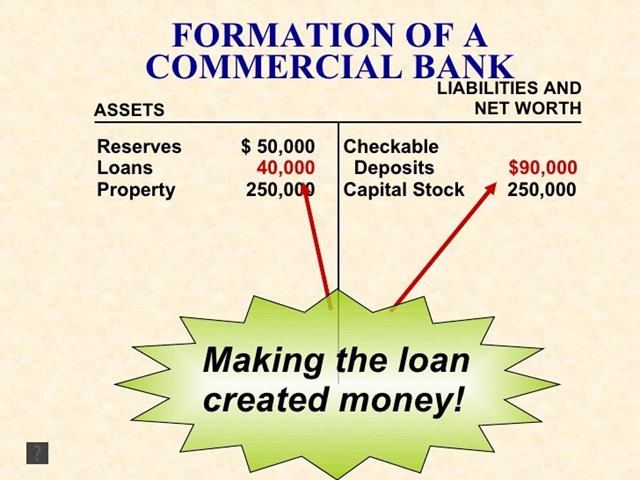

PayPal offers the ability to transfer money to and from any U.S.-based bank account and many foreign accounts. There is no fee to transfer funds to family or friends from a PayPal balance or bank account balance, but PayPal does charge fees to send from a credit card or convert currencies. Zelle is a money-sending app that allows direct bank-to-bank transfers between individuals. If you and the person you're sending money to have accounts with a participating bank, you can send funds within the same business day.

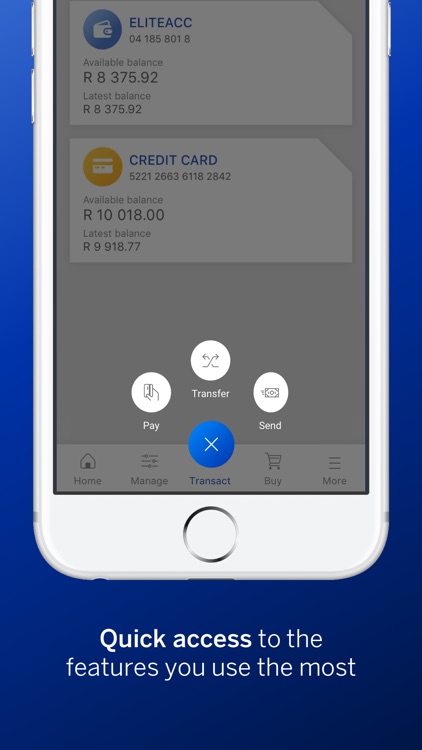

Participating banks include Bank of America, Chase, Wells Fargo, Capital One and Ally, among others. In most cases, individuals are able to transfer funds via Zelle within their banking app rather than having to download a separate app. The service is free, and funds can often arrive in your account in a matter of minutes. The Chase app allows you to pay bills, transfer money to friends via Zelle, and schedule payments for your credit card, mortgage or other loans.

You can also see your TransUnion credit score in the app. And if you have one of Chase's popular rewards credit cards, you can also view and redeem your Ultimate Rewards through the app. Some payday advance apps also offer budgeting tools to help you track and manage your spending or automated savings tools to help you build up your emergency fund. Many also provide ways to help you earn extra money through cash-back rewards, extra shifts, or side gigs. With the help of these tools, you won't need to rely on cash advances to cover those unplanned expenses; you'll have money in the bank to take care of them. You link your bank account information and credit cards to the app, and it securely stores it so you can use it to send and receive money directly on the app.

You don't need to have your wallet physically with you, and some apps can even be used internationally. It's a quick and convenient way to send and receive money and pay for things online and in stores. Facebook Messenger is a surprisingly convenient way to send money to family, friends, and other people you're connected with on Facebook.

The payment feature is free to use and already integrated with Messenger. The service requires using a debit card, and recipients will also have to provide their own debit card information in order to receive a payment. Given Facebook's privacy concerns, some people may be wary of forking over their debit card info to the company. Fund transfers are also somewhat slower than other money-sending apps, at one to five days.

This is where money transfer apps really excel, which have blossomed in much the way way as personal finance software. Transfer apps offer the ability to send money across the world using different currencies in a way that is simple, easy, and pain-free. Once upon a time, features like mobile check deposit were considered cutting edge. Now, consumers have come to expect that kind of functionality, along with seamless money transfers, bill pay, ATM locators and more. Today, some apps will even let you track accounts from different financial institutions.

Others offer built-in financial wellness and budgeting platforms. If mobile offerings are a deciding factor for you in choosing a bank, we've assembled this list of the best banking apps on the market. The FlexWage app for employers works a little differently from DailyPay and PayActive. When you sign up for the app as an employee, you receive a reloadable debit card for your wages, which takes the place of a paper paycheck. This gives you immediate access to your money on payday, unlike a check you deposit at the bank. You can use the card at any retailer that accepts Visa and at any Allpoint ATM, or transfer the cash to a bank account for free.

Another online banking app that offers a combination of early cash advances and early paycheck access is MoneyLion. Its Instacash feature lets you borrow up to $250 of your next paycheck with no interest and no credit check. This feature is available 24/7, and the money appears in your account within seconds. And, at the same time, its online RoarMoney account gives you access to your paycheck up to two days early.

The MoneyLion app offers mobile bank and investment accounts, financial tracking, a credit-builder loan and cash advances up to $250. The Instacash advance is available to anyone with a qualifying checking account. However, you'll have to pay a fee if you don't have a MoneyLion account and need your funds quickly. MoneyLion says it charges no interest or fees with the cash advance, but you're asked to provide an optional tip if you get an advance. Users pay 2.90% plus a fixed fee to send money via a credit card.

PayPal charges 5% to send international personal transactions using a PayPal balance, bank account, or through an Amex Send account. Credit card payments for international transactions cost 7.90% plus a fixed fee. Once your paycheck is paid via direct deposit, Earnin automatically deducts the amount you cashed out earlier in the pay cycle.

Anyone who has over 50% of their direct deposit sent a checking account, has a regular pay schedule, and a fixed work location or online timekeeping system can use Earnin. You are not allowed to use Earnin to send money to prepaid and savings accounts or payout earnings from SSI, unemployment, or disability pay. My Money Manager looks at how and where you spend using the information from any current account, savings account or credit card you have with us.

It's in your mobile banking app so you just have to sign up and you'll be able to receive insights and see them in the app. Some payment apps are completely free, while others have free aspects like receiving money or sending money between friends and family. Some payment apps may charge fees to receive money quicker than the standard time, currency exchange and processing fees, and credit card fees.

These fees vary based on the type, amount, and location of the transaction. Create budgets that work for your own personal needs and make it easy to reach your goals. Using this app can help you avoid overdraft fees and can also help you easily spot recurring expenses, such as that morning coffee, that are real budget-busters. Plus you can get custom tips for reducing fees and saving money and receive alerts for unusual accounts charges, which could help you catch fraudulent activity.

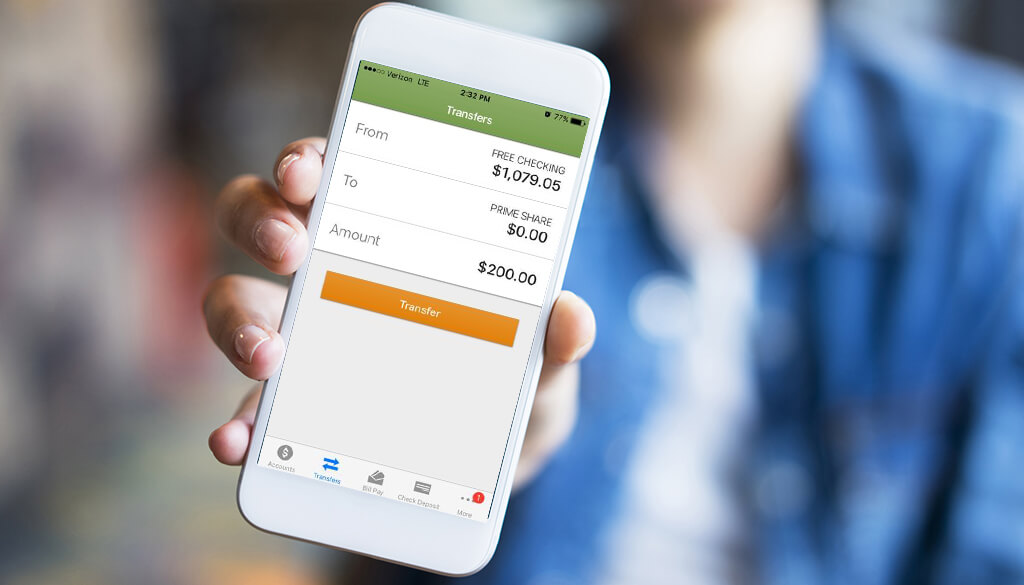

Most person-to-person payments are free with these apps, unless you use a credit card rather than a bank account or debit card. A fee of about 3 percent comes from the credit card provider when you use that as your payment source. Send money instantly to friends using our mobile banking app. Our Pay Friends feature allows you to send fee-free mobile payments to friends or family when they open an account with Chime. No transaction fees or monthly fees for sending payments.

Unlike most major bank apps, the Chase app allows you to reload your Chase Liquid debit card. In fact, it offers access to most of your accounts including checking, savings, and credit card options as well as investments. The standard bank transfer through the ACH network to a verified checking account typically takes one to three business days to arrive. You can also choose an instant transfer to a bank account or debit card (incurs a 1% fee) which arrives within 30 minutes. As with other platforms on this list, you can link debit cards and bank accounts to Cash App and transfer money for free.

But if you use a credit card for funding, the app will charge you a three percent levy. Chime is one of the best online banking apps like Dave and a top provider of various financial tools. The app allows you to get a paycheck early, access a fee-free overdraft facility, grow your savings, and manage all your finances. By using its online banking platform, you can get a free Visa Debit Card, savings account, and spending account. Simply enter your tracking number to see when it's been processed, collected and completed. The option of paying direct from your bank account, via card or in cash adds to the convenience factor, as does integration with Apple Pay.

MoneyLion is banking that gives you more, a lot more so you can get paid today. You can get spotted $250 at any time with no interest with Instacash. This gets you 0% APR cash advances up to $250 to help you cover essentials and surprises, just apply here and link your checking account .

Plus, you can get your paycheck up to two days early with RoarMoney – plus easy ways to borrow, save, invest, and earn. With Chime's mobile app, money transfers just got a whole lot easier. Easily transfer your money between your Spending Account and Savings Account when you need it with just a few taps.

If you don't like to carry your card around or often forget to bring it with you, the PNC mobile banking app may be right for you. While some banking apps let you use your phone as your debit card, PNC Bank extends access to your credit and SmartAcess Cards. With this app, you'll never have to worry about not being able to make a purchase because you misplaced or lost your card. Like Chime and Axos, SoFi Money gives you access to your pay up to two days early with direct deposit. Thanks to online banking, you can manage your money anytime, almost anywhere.

Use online bill pay to pay your monthly bills and Mobile Deposit to deposit checks using your mobile device's camera without having to add a trip to the bank. Plus, access other online tools like digital payments, automatic savings and CreditWise. With Capital One online banking, you choose when, where and how to bank. You can access your account online or through the Capital One Mobile app.

With built in security and 24/7 access, your money is always at your fingertips. Keep in mind, web access is needed to use mobile banking and Mobile Deposits are available only in the U.S. and U.S. Remember to check with your service provider for details on specific fees and charges.

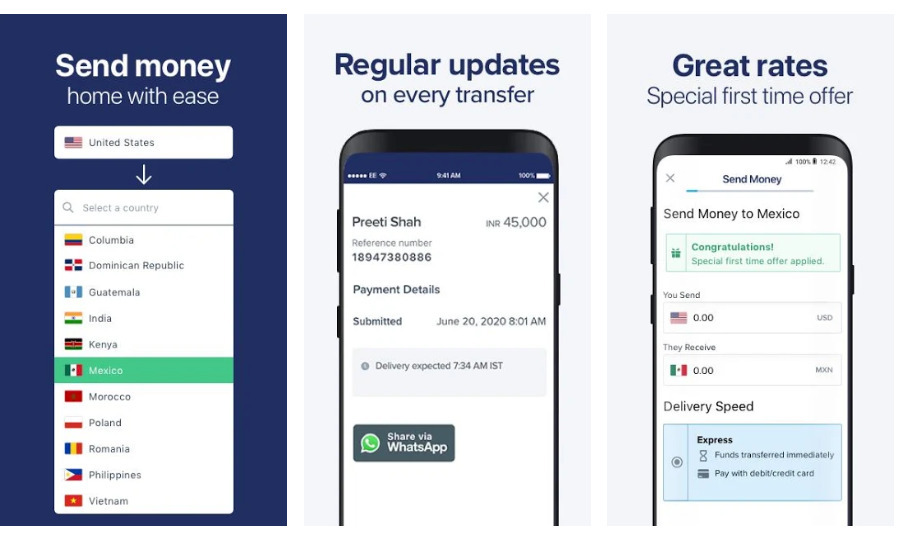

Venmo can also be used to pay for transactions at many businesses as well. It is free to send money using your linked debit card bank account. WorldRemit is a good choice for the best money-sending app for international transfers. While some other money-sending apps have limited international capabilities, WorldRemit is specifically designed to facilitate international transfers. The app is simple and easy to use and you can send money to more than 150 countries around the world.